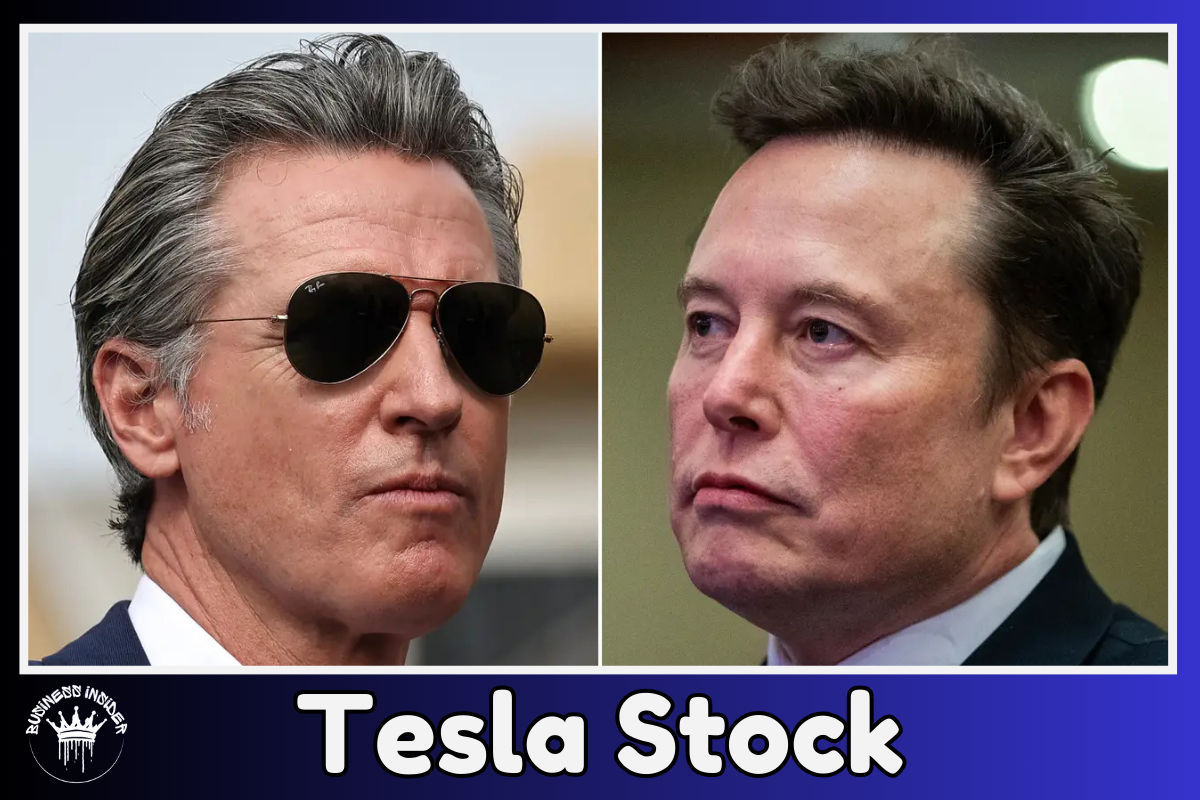

Governor Gavin Newsom of California is preparing to take action if Donald Trump follows through on his pledge to eliminate the federal electric vehicle (EV) tax credit — but the state’s response could leave one major EV manufacturer out. This move could have significant implications for companies like Tesla, whose stock has been a key player in the EV market.

On Monday, Newsom announced that he plans to revive California’s rebate program for zero-emission vehicles if the federal government eliminates the $7,500 tax credit for EVs. The program phased out in 2023. “We will act if the Trump Administration removes the federal tax credit,” Newsom said. “California remains committed to clean air and green jobs. We won’t reverse progress on clean transportation. Instead, we’ll make non-polluting vehicles more affordable.”

California’s Greenhouse Gas Reduction Fund will fund the rebate program, receiving money from companies that emit greenhouse gases under the state’s cap-and-trade system.

However, Tesla vehicles could be excluded from this proposal due to potential market-share limitations, as first reported by Bloomberg News. The governor’s office told Business Insider the rebate program might include a cap on market share. This could exclude Tesla stock or other EV manufacturers. Specific details on the cap were not shared. The proposal still needs approval from the California Legislature.

A market-share cap would exclude companies whose sales represent a certain percentage of total EV sales. For example, Tesla made up nearly 55% of all new electric vehicle registrations in California during the first three quarters of 2024, according to the California New Car Dealers Association. By comparison, Hyundai and BMW had market shares of just 5.6% and 5%, respectively. Despite recent declines in Tesla’s California sales, the company still holds the largest share of the state’s EV market. However, its dominance has slightly waned, dropping from 64% to 55% year-over-year.

The governor’s office stated that the market-share cap would encourage more competition and innovation in the EV industry.

Elon Musk, who has previously expressed support for ending the federal tax credit, criticized the California proposal in a post on X, calling it “insane” to exclude Tesla stock. Musk, with close ties to the incoming Trump administration, will co-lead an advisory commission to cut federal spending. During a July earnings call, he mentioned that ending the federal tax credit might hurt competitors. However, he also stated that it could benefit Tesla over time. The credit, introduced under the 2022 Inflation Reduction Act, gives EV buyers $7,500.

Newsom, a vocal critic of the Trump administration, called for a special legislative session to shield California from Trump’s second term. Dan Ives, an analyst at Wedbush Securities, said this could ignite a “Game of Thrones”-style clash between Newsom and Musk. It might also push Tesla to move more jobs out of California.

Potential Impacts on California’s EV Market

If the federal EV tax credit is repealed and California excludes Tesla from its rebate program, the state’s EV market could change significantly. The rebate program aims to support competition and help new EV manufacturers. However, excluding a major player like Tesla could disrupt the industry.

Smaller companies could benefit from increased incentives, but consumers loyal to Tesla stock may face higher costs, potentially slowing adoption rates. Analysts warn the move could have widespread effects. It may impact California’s climate goals and the competitive position of EV makers in the largest U.S. EV market.